clsteel.site

Prices

Is Buying Gold A Safe Investment

Investing in gold can stabilize your portfolio during market declines and safeguard against inflation. · Investing in tangible objects such as gold comes with a. Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the. Gold isn't really an investment because it does not earn interest or produce anything. It is more like a savings plan. You know it will always. Bottom line on investing in gold Gold can provide a way to add alternative assets to an investor's portfolio. However, before moving forward, investors need. The truth is gold and other precious metals are highly volatile and past performance is not a good predictor of future returns. There is no time like the present to invest in gold coins. They have remained a highly lucrative investment option for thousands of years. They are a long-term. “Gold is considered a safe haven, because it tends to do well in times of economic distress. However, the precious metal is actually pretty volatile, and heavy. Gold investment options range from physical to financial, providing diverse choices for investors. · Physical gold faces cost and liquidity challenges, while. While precious metals can offer additional diversification to an investment portfolio, they are subject to the same pressures of supply and demand as other. Investing in gold can stabilize your portfolio during market declines and safeguard against inflation. · Investing in tangible objects such as gold comes with a. Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the. Gold isn't really an investment because it does not earn interest or produce anything. It is more like a savings plan. You know it will always. Bottom line on investing in gold Gold can provide a way to add alternative assets to an investor's portfolio. However, before moving forward, investors need. The truth is gold and other precious metals are highly volatile and past performance is not a good predictor of future returns. There is no time like the present to invest in gold coins. They have remained a highly lucrative investment option for thousands of years. They are a long-term. “Gold is considered a safe haven, because it tends to do well in times of economic distress. However, the precious metal is actually pretty volatile, and heavy. Gold investment options range from physical to financial, providing diverse choices for investors. · Physical gold faces cost and liquidity challenges, while. While precious metals can offer additional diversification to an investment portfolio, they are subject to the same pressures of supply and demand as other.

This is why, traditionally, gold is seen as a 'safe-haven' investment. In Whilst The Royal Mint is able to buy back gold through our 'Sell Gold. But Gold Can Indeed Be a Good Hedge in a Crisis Gold can soar in value during hard times, when investors are fearful and uncertain and seek safety. Just look. While gold as a precious metal is often considered a reliable investment and much better than paper-based currency, it can be quite difficult to gauge the best. 5-STEP GUIDE · Choose the right gold product for you · Confirm the product you're buying is legitimate · Evaluate the costs & fees · Recognize sales & marketing. Through the years, gold has served as a hedge against inflation and the erosion of major currencies, and thus is an investment well worth considering. Article. While it may not offer the high returns of more volatile assets, gold provides balance to a portfolio that can reduce risk and preserve capital over time. Gold has proven be a very volatile investment, so don't put a large amount into it, keep it to less than 10% of your overall investments. In. It can Protect Against Inflation Risks · A Good Way to Save Money for Future · Easy to Buy and Very Easy to Sell in the Market · Does not Require Much Maintenance. Do not do business with a dealer who guarantees your purchases are totally safe, will go up in value or can't go down, stresses government gold confiscation or. What are the advantages of gold bullion? Gold is renowned as a safe investment, and its ability to consistently hold its value appeals to governments, banks. Precious metals are commodities that should be safely stored, which may impose additional costs on the investor. The Securities Investor Protection Corporation. Gold is considered a safe investment. A huge amount of investment in gold comes from individuals looking to protect their wealth from the dangers of economic. Short Answer: Over the long term, yes. Very safe. Long answer: Gold has stood the test of time. It has maintained its value relative to. Ultimately though, gold is seen as a good long-term investment, protecting your money over the years. It offers strong potential returns, at low risk, and is. The most common way to invest in physical gold is to purchase gold bullion. Gold bullion refers to investment-grade gold, commonly in the form of bars, ingots. Gold is not risk-free Investors often see gold as a 'safe haven' during periods of uncertainty, but all sorts of factors can have an impact on its price. Never-ending demand: Another advantage of gold is its never-ending demand around the world. Its use in different products, such as jewellery and electronics. If you agree with the views put forward above about gold's value as part of a portfolio to guard against shocks to other investments, then any time would be a. Gold is not risk-free Investors often see gold as a 'safe haven' during periods of uncertainty, but all sorts of factors can have an impact on its price. This makes it an ideal investment as gold has a history of holding its value over time and is there when you need it, unlike some potentially riskier.

S&P 500 Index Index

Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. Interactive chart of the S&P stock market index since Historical data is inflation-adjusted using the headline CPI and each data point represents the. SPX | A complete S&P Index index overview by MarketWatch. View stock market news, stock market data and trading information. S&P Index overview: see client sentiment and spot trading opportunities for IG's US stock index which is based on S&P Index. SVSPX - State Street S&P Index N - Review the SVSPX stock price, growth, performance, sustainability and more to help you make the best investments. The index has returned a historic annualized average return of around % since its inception through the end of While that average number may. Overview: As its name suggests, the Vanguard S&P tracks the S&P index, and it's one of the largest funds on the market with hundreds of billions in the. The S&P index covers the largest companies that are in the United States. These companies can vary across various sectors. The S&P is one of the. The S&P is regarded as a gauge of the large cap US equities market. The index includes leading companies in leading industries of the US economy. Find the latest S&P (^GSPC) stock quote, history, news and other vital information to help you with your stock trading and investing. Interactive chart of the S&P stock market index since Historical data is inflation-adjusted using the headline CPI and each data point represents the. SPX | A complete S&P Index index overview by MarketWatch. View stock market news, stock market data and trading information. S&P Index overview: see client sentiment and spot trading opportunities for IG's US stock index which is based on S&P Index. SVSPX - State Street S&P Index N - Review the SVSPX stock price, growth, performance, sustainability and more to help you make the best investments. The index has returned a historic annualized average return of around % since its inception through the end of While that average number may. Overview: As its name suggests, the Vanguard S&P tracks the S&P index, and it's one of the largest funds on the market with hundreds of billions in the. The S&P index covers the largest companies that are in the United States. These companies can vary across various sectors. The S&P is one of the. The S&P is regarded as a gauge of the large cap US equities market. The index includes leading companies in leading industries of the US economy.

S&P Key Figures ; Performance, %, % ; High, 5,, 5, ; Low, 5,, 5, ; Volatility, , Get S&P Index live stock quotes as well as charts, technical analysis, components and more SPX index data. Vanguard S&P ETF is an exchange-traded share class of Vanguard Index Fund. Using full replication, the portfolio holds all stocks in the same. S&P Index Values ; 3/15/, 3,, % ; 2/15/, 4,, % ; 1/15/, 3,, % ; 12/15/, 3,, %. Get S&P Index .SPX:INDEX) real-time stock quotes, news, price and financial information from CNBC. Invests in a portfolio of assets whose performance seeks to match the performance of the S&P ® Index. S&P Index advanced index charts by MarketWatch. View real-time SPX index data and compare to other exchanges and stocks. Analyze the Fund Fidelity ® Index Fund having Symbol FXAIX for type mutual-funds and perform research on other mutual funds. Learn more about mutual. Get S&P INDEX .SPX) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. State Street S&P Index Fund - Class N SVSPX · Derivative investments may involve risks such as potential illiquidity of the markets and additional risk of. A straightforward, low-cost fund with no investment minimum; The Fund can serve as part of the core of a diversified portfolio; Simple access to leading. The S&P Growth measures constituents from the S&P that are classified as growth stocks based on three factors: sales growth, the ratio of earnings. iShares Core S&P ETF; Schwab S&P Index Fund; Shelton NASDAQ Index Direct; Invesco QQQ Trust ETF; Vanguard Russell ETF; Vanguard Total Stock. About S&P Index. . Standard and Poor's Index is a capitalization-weighted stock market index measuring the performance of large publicly traded. Find the latest S&P INDEX (^SPX) stock quote, history, news and other vital information to help you with your stock trading and investing. Widely regarded as one of the best gauges of the U.S. equities market, this world-renowned index includes a representative sample of top companies in. IVE · iShares S&P Value ETF, Equity ; JEPI · JPMorgan Equity Premium Income Fund, Equity ; DGRO · iShares Core Dividend Growth ETF, Equity ; SPYV · SPDR. S&P Index · S&P Index ($SPX) · Percentage of S&P Stocks Above Moving Average · Summary of S&P Stocks With New Highs and Lows · S&P ETF. Get S&P Index live stock quotes as well as charts, technical analysis, components and more SPX index data. View the full S&P Index (SPX) index overview including the latest stock market news, data and trading information.

Real Estate Investment Financing Options

Option 1. Cash-Out Refinance. One of the quickest creative financing options you have available, if you own the home you live in, is to tap into your existing. Types of Real Estate Loans. Commercial; Industrial; Mixed-Use; Residential; Multi-Family. Icon. I would suggest new real investor financing through hard money loans, hybrid loans, asset-based mortgages, and an FHA loan”. For investors wondering how to. Options for a Rental Property Loan · 1. Conventional · 2. FHA · 3. VA · 4. Portfolio · 5. Blanket · 6. Private · 7. Seller Financing · 8. HELOC. Yes, you can use a Home Equity Line of Credit (HELOC) or Home Equity Loan to buy an investment property, but there are certain factors and considerations to. I would suggest new real investor financing through hard money loans, hybrid loans, asset-based mortgages, and an FHA loan". For investors wondering how to. Investment real estate lending at Bank of America Private Bank offers you a broad range of experience and the ability to bring you choices and flexibility many. Investment real estate financing allows you to use equity in commercial real estate you own to quickly access cash that can be used for business or portfolio. What's an investment property loan? Investment property loans are used for the purchase of second homes and investment properties, including one- to four-unit. Option 1. Cash-Out Refinance. One of the quickest creative financing options you have available, if you own the home you live in, is to tap into your existing. Types of Real Estate Loans. Commercial; Industrial; Mixed-Use; Residential; Multi-Family. Icon. I would suggest new real investor financing through hard money loans, hybrid loans, asset-based mortgages, and an FHA loan”. For investors wondering how to. Options for a Rental Property Loan · 1. Conventional · 2. FHA · 3. VA · 4. Portfolio · 5. Blanket · 6. Private · 7. Seller Financing · 8. HELOC. Yes, you can use a Home Equity Line of Credit (HELOC) or Home Equity Loan to buy an investment property, but there are certain factors and considerations to. I would suggest new real investor financing through hard money loans, hybrid loans, asset-based mortgages, and an FHA loan". For investors wondering how to. Investment real estate lending at Bank of America Private Bank offers you a broad range of experience and the ability to bring you choices and flexibility many. Investment real estate financing allows you to use equity in commercial real estate you own to quickly access cash that can be used for business or portfolio. What's an investment property loan? Investment property loans are used for the purchase of second homes and investment properties, including one- to four-unit.

This is the option that will allow you to get into the property for a minimal amount, while still having ownership. Most investment loan programs require. Government-Backed Loans · FHA Loans: The Federal Housing Administration (FHA) offers loans that are ideal for first-time investors in multi-unit. This no-nonsense guide contains everything you must know to make the right choices about financing your investments. All debt crowdfunding options are secured by the property being developed. Typically, investors are repaid within two years or less and receive a share of. There are many loan options available for commercial real estate investment properties. But first, make sure you are building and maintaining a strong business. Our California DSCR Loans are perfect rental loans for the long-term real estate investor looking for cash flow. Our California Hard Money Loans are ideal for. 1. Know your options. The real estate market has a variety of financing options available for investors. · 2. Work with a Private Lender or Mortgage Broker · 3. 1. Private Money Lenders · 2. Hard Money Lenders · 3. Wholesaling · 4. Equity Partnerships · 5. Home Equity · 6. Option To Buy · 7. Seller Financing · 8. House Hacking. Real estate financing refers to the methods and options available for buyers, sellers, and investors to fund real estate transactions. Whether you're a. This blog post will explore hard money and cash financing options for real estate investing. We'll provide each option's definitions, characteristics. I would suggest new real investor financing through hard money loans, hybrid loans, asset-based mortgages, and an FHA loan". For investors wondering how to. We offer fixed & adjustable-rate investment property and second home loan options. Learn more and get prequalified actual second-property owners, lenders and. The right commercial real estate financing can enable you to acquire, refinance or even build investment properties. Conventional mortgages, government-insured loans (FHA, VA, USDA), and jumbo loans are among the most common mortgage options. Borrowers must understand the. These are one of the most favored options for potential investors. Taking a bank loan and paying back in EMIs is common. One of the biggest advantages of buying. Why Get an Investment Property Loan? · Rental opportunity: Renting out your property to tenants creates additional cash flow. · Increased cash flow: Your. Provide options for fixed and variable-rate mortgages · Allow competitive rates, though lenders may charge a small premium · Give you up to 80% Loan-to-Value (LTV). An investment property loan can help you purchase an income-generating property. You might intend to rent this property or flip it for a profit. Either way. Conventional loans are a good solution for buy-and-hold investors building a portfolio of income-producing rental properties. They are not typically used to. real estate opportunity, RBC can help with an Investment Property Mortgage financing for up to 80% of the appraised value of your rental property. A.

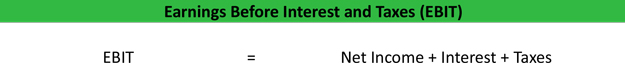

Earning Before Interest And Taxes

EBITDA is short for earnings before interest, taxes, depreciation and amortization. It is one of the most widely used measures of a company's financial health. However, some interest you receive may be tax-exempt. If you received payments of interest and/or tax-exempt interest of $10 or more, you should receive Copy B. EBITDA, or earnings before interest, taxes, depreciation, and amortization, is an alternative measure of a company's overall financial performance. EBITDA stands for earnings before interest, tax, depreciation and amortization. Business earning are subject to taxes. Let us assume that tax rate = EBITDA represents net income (loss) before interest expense, provision for income taxes, depreciation and amortization. Earnings Before Interest and Taxes (EBIT) is a financial metric that provides valuable information on the profit metrics of the underlying business or company. Earnings before interest and taxes is a measurement of your company's profitability. It enables you to calculate your revenue, minus expenses (including. Earnings before Interest, Taxes, Depreciation, and Amortization Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a measure of. Earnings before interest and taxes (EBIT) indicate how effectively a company generates earnings over a specific period of time. EBITDA is short for earnings before interest, taxes, depreciation and amortization. It is one of the most widely used measures of a company's financial health. However, some interest you receive may be tax-exempt. If you received payments of interest and/or tax-exempt interest of $10 or more, you should receive Copy B. EBITDA, or earnings before interest, taxes, depreciation, and amortization, is an alternative measure of a company's overall financial performance. EBITDA stands for earnings before interest, tax, depreciation and amortization. Business earning are subject to taxes. Let us assume that tax rate = EBITDA represents net income (loss) before interest expense, provision for income taxes, depreciation and amortization. Earnings Before Interest and Taxes (EBIT) is a financial metric that provides valuable information on the profit metrics of the underlying business or company. Earnings before interest and taxes is a measurement of your company's profitability. It enables you to calculate your revenue, minus expenses (including. Earnings before Interest, Taxes, Depreciation, and Amortization Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a measure of. Earnings before interest and taxes (EBIT) indicate how effectively a company generates earnings over a specific period of time.

Earnings before interest and taxes (EBIT) are calculated before payments to creditors and shareholders. That is why EBIT is considered the company's operating. EBIT is the profits of the firm before the impact of interest income, interest expense, and tax expense. The major difference between EBIT Multiple and PE ratio. Integrated Media stakeholders use historical fundamental indicators, such as Integrated Media's Earning Before Interest and Taxes EBIT, to determine how well. To calculate a company's EBITDA, we start with net income and add back several expenses, namely interest, taxes, depreciation, and amortization. The net income. What is EBIT? EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net income. EBITDA is calculated on the basis of the company's final operating profit, excluding financial items (interest on debt), taxes, changes in the value of fixed. (b) defining EBIT as profit before finance income/expenses and tax. Page 2. Agenda ref. 21A. Primary Financial Statements│EBIT. Page. EBITDA stands for earning before interests, taxes, depreciation and amortization, which means it represents the value that is left after adding interests. EBIT is the amount of money a company makes without taking into account interest or taxes and is commonly used to this measure operating profits or operating. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization and is a metric used to evaluate a company's operating performance. EBIT (Operating Income) in Financial Models and Valuation. EBIT is a starting point for the Net Operating Profit After Taxes (NOPAT) and Unlevered Free Cash. Earnings before interest and, taxes (EBIT). Browse Terms By Number or Letter: A financial measure defined as revenues less cost of goods sold and selling. EBIT (Earnings Before Interest and Taxes) is a proxy for core, recurring business profitability, before the impact of capital structure and taxes. EBITDA. Earnings Before Interest And Taxes is a firm's total income before the deduction of the interest costs and the tax expenses. EBIT is also called operating. Earnings before interest and, taxes (EBIT). Browse Terms By Number or Letter: A financial measure defined as revenues less cost of goods sold and selling. It's also known as EBIT (earnings before interest and taxes) It's also known as EBIT (earnings before interest and taxes). It's important to note that. EBIT Calculator simply returns earnings before interest and tax (EBIT). EBIT is a company's profit after deducting all operating cost expect interest and. EBIT or earnings before interest and taxes, also called operating income, is a profitability measurement that calculates the operating profits of a company. What Is Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)?. EBIDTA is the acronym for Earnings Before interest taxes depreciation and.

Loans For People With Loans

At Cash 4 You, you can apply for a long-term personal loan to borrow up to $15, to cover any type of personal expense, no questions asked. Installment loans. Personal loans & lines. Loans & credit lines. Personal loan calculator. Debt consolidation. Debt consolidation calculator. Home repair financing. We offer no credit and bad credit loans, as well as bankruptcy loans, with % secure information and as direct lenders. Credit Scores, Credit Reports & Credit Check Offers › Personal Loans Find the funds you need now — fast, easy, secure. Find personal loans with low monthly payments through Engine by MoneyLion, a loan search engine and Earnest partner. Enter your details, get your rates. Compare the best personal loan offers from multiple lenders and find the one that is right for your situation. Get matched with an offer tailored to your. Kiva is the world's first online lending platform. For as little as $25 you can lend to an entrepreneur around the world. Learn more here. If you're under 18 years old: We welcome you to apply for a Start Personal Loan, as long as you have a parent or other co-signer on your loan. Parents will have. Magical Credit specializes in personal loans for people with less than perfect credit history! Our short term personal loans let you enjoy the advantages of. At Cash 4 You, you can apply for a long-term personal loan to borrow up to $15, to cover any type of personal expense, no questions asked. Installment loans. Personal loans & lines. Loans & credit lines. Personal loan calculator. Debt consolidation. Debt consolidation calculator. Home repair financing. We offer no credit and bad credit loans, as well as bankruptcy loans, with % secure information and as direct lenders. Credit Scores, Credit Reports & Credit Check Offers › Personal Loans Find the funds you need now — fast, easy, secure. Find personal loans with low monthly payments through Engine by MoneyLion, a loan search engine and Earnest partner. Enter your details, get your rates. Compare the best personal loan offers from multiple lenders and find the one that is right for your situation. Get matched with an offer tailored to your. Kiva is the world's first online lending platform. For as little as $25 you can lend to an entrepreneur around the world. Learn more here. If you're under 18 years old: We welcome you to apply for a Start Personal Loan, as long as you have a parent or other co-signer on your loan. Parents will have. Magical Credit specializes in personal loans for people with less than perfect credit history! Our short term personal loans let you enjoy the advantages of.

Easily apply for a personal loan online in 3 steps. Prequalify Find the rate that you qualify for in 60 seconds with no commitment. Personal loans from OneMain can help consolidate debt or fund a major purchase. Apply online for loans of up to $ with fixed rates & payments. Enjoy low rates and flexible terms from Georgia United's Personal Loans. Our loans are approved and granted quickly, giving you access to the funds you need. Happy Money. Helping fund what makes you happy with personal loans to help you reach your goals. Empowering people to use money as a tool for their. Bad credit loans are designed for people with poor credit. Money Mart offers bad credit loans with flexible repayment options. Apply online or in person. KeyBank offers unsecured personal loans with a fixed rate that requires no collateral. Find a low-interest-rate loan that works for you. Apply today. You can use a personal loan to knock out debt, finance a big purchases or plan the wedding of your dreams — but make sure you factor in the costs. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online. An unsecured personal loan is a great choice to consolidate debt, or to pay for home improvements, a wedding, or a vacation. Check your rate for an online personal loan in minutes without affecting your credit score. Get funded in as fast as 1 business day. Why apply for a Personal Loan? · Borrow up to $50, up front · Payments that fit your budget · Interest rate options. SoFi Personal Loans are available from $5, to as much as $,, which makes them a great option for those who need more money to cover bigger expenses. Browse and find personal, debt consolidation, and student loans with monthly Find your info on people finder sites. Identity Theft support. Security. A personal loan can be great to pay down debt, finance home improvement and more. Get advice on personal loans and apply for a loan today. Explore our experts' picks of the best personal loans of , including reputable companies like SoFi, LightStream and LendingPoint. How to Apply for a Personal Loan · 1. Apply In Minutes. Get customized loan options based on what you tell us. · 2. Choose a Loan Offer. Select the rate, term. Prosper makes it easy to apply for a personal loan and to check your rate and estimated monthly payments without affecting your credit score. If you're eligible. Online Installment Loan Lender | Apply for your online installment loan and get up to $ Get the cash you need as early as the next business day. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Personal loans are offered by all sorts of lenders, including traditional banks, credit unions, online banks and peer-to-peer (P2P) lending sites. Many.

Gross Income Statement

This financial statement shows how much money the business will make after all expenses are accounted for. An income statement does not reveal hidden problems. Once you have your revenue and COGS, you can simply subtract COGS from revenue to arrive at gross profit. Although there are still many more expenses to be. Gross profit or gross income is a key profitability metric since it shows how much profit remains from revenue after deducting production costs. Gross profit. The income statement summarizes the firm's revenues and expenses and shows its total profit or loss over a period of time. The statement displays the company's revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in. The income statement indicates whether a business has earned money or suffered a loss. Actual financial statements help evaluate past performance. The components of the income statement include: revenue; cost of sales; sales, general, and administrative expenses; other operating expenses; non-operating. Single-step vs. multistep income statement · Step 1: Gross profit = net sales – cost of goods sold · Step 2: Operating income = gross profit – operating expenses. An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement. This financial statement shows how much money the business will make after all expenses are accounted for. An income statement does not reveal hidden problems. Once you have your revenue and COGS, you can simply subtract COGS from revenue to arrive at gross profit. Although there are still many more expenses to be. Gross profit or gross income is a key profitability metric since it shows how much profit remains from revenue after deducting production costs. Gross profit. The income statement summarizes the firm's revenues and expenses and shows its total profit or loss over a period of time. The statement displays the company's revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in. The income statement indicates whether a business has earned money or suffered a loss. Actual financial statements help evaluate past performance. The components of the income statement include: revenue; cost of sales; sales, general, and administrative expenses; other operating expenses; non-operating. Single-step vs. multistep income statement · Step 1: Gross profit = net sales – cost of goods sold · Step 2: Operating income = gross profit – operating expenses. An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement.

Gross revenue refers to the total amount of revenue earned in a given reporting period. Found on the first line of your income statement, gross revenue is also. An annual income statement is prepared for the fiscal or calendar year ended on a company's selected year-end date. Income Statement vs Multi Step Income. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's. An income statement is a financial report used by a business. It tracks the company's revenue, expenses, gains, and losses during a set period. Your income statement (sometimes called a statement of revenue and expense) shows the revenue your practice earned and the costs associated with running your. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. Net income is the profit that remains after. On a financial statement, the income statement shows revenues less expenses. In this way, the financial statement shows a company's net income for the. It indicates how the revenues (also known as the “top line”) are transformed into the net income or net profit (the result after all revenues and expenses have. The income statement shows, for a stated period of time, the total amount of revenue from the sale of products or services, the total expenses involved in. Conceptually, the income statement is very straightforward, but it does use specific terminology that needs to be clarified. Start with gross revenue, the total. The four key components of an income statement are: Revenues and gains – for total income. Expenses and losses – for total costs. Gross Margin Ratio: Gross Profit ÷ Net Sales. This measures the percentage of sales dollars available to pay the overhead expenses of the company. A related. The Internal Revenue Service requires all businesses to submit this report at the end of each year. PROFIT AND LOSS STATEMENT. From: 20 to. Sales or Gross. Gross Profit Gross Profit represents a measure of a company's operating performance. Gross Profit states the profits earned directly from a company's revenues. This section represents your gross revenue or net revenue. This figure represents your total sales for the period by revenue type. This line could also be known. It indicates how the revenues (also known as the “top line”) are transformed into the net income or net profit (the result after all revenues and expenses have. The income statement is one of most important financial statements, because of it directly displays potential of profits. The other important documents are the. Revenue minus expenses equals profit or loss. An income statement might use the cash basis or the accrual basis. The income statement is a useful way to see how. Contra revenue adjustments are deductions from gross revenue. Applying the contra revenue to your gross revenue results in your net income. Use this report. Gross income refers to the total income earned by an individual on a paycheck before taxes and other deductions.

Que Es Swing Trading

Swing trading is an investment strategy that takes advantage of short-term price movements. It involves taking positions in stocks or other securities with the. TikTok video from Arion Soté | Swing Trader (@swingtradenapratica): “Imagine que Que Es Trading · Donde Hacer Trading Sensei · Forex Trading Tips · Forex. Swing trading seeks to capture short-term gains over a period of days or weeks. Swing traders may go long or short the market to capture price swings. esto es algo bueno, ya que aquí estás casi solo. Este libro describe el método de swing trading utilizado por el Heikin Ashi. Trader. Es ideal para aquellos. Swing trading · Noticias y análisis · Ayuda · Ayuda · Temas de ayuda es obtener más información acerca de los productos y servicios que ofrece CMC Markets. Question: ¿Qué es el swing trading? Answer: El swing trading es una estrategia de corto plazo en la que se compran y venden activos para aprovechar las. ¿Qué es el Swing Trading? Uno de los tipos de negociación más populares, tanto entre los traders principiantes como experimentados, es trading a medio plazo. trading, swing trading, and position trading—offers distinct que aparecen en este sitio web son marcas registradas. El logotipo de Quadcode es. Swing trading is a strategy that typically seeks to capture and capitalize on short to medium-term price movements within a broader trend. Unlike a day investor. Swing trading is an investment strategy that takes advantage of short-term price movements. It involves taking positions in stocks or other securities with the. TikTok video from Arion Soté | Swing Trader (@swingtradenapratica): “Imagine que Que Es Trading · Donde Hacer Trading Sensei · Forex Trading Tips · Forex. Swing trading seeks to capture short-term gains over a period of days or weeks. Swing traders may go long or short the market to capture price swings. esto es algo bueno, ya que aquí estás casi solo. Este libro describe el método de swing trading utilizado por el Heikin Ashi. Trader. Es ideal para aquellos. Swing trading · Noticias y análisis · Ayuda · Ayuda · Temas de ayuda es obtener más información acerca de los productos y servicios que ofrece CMC Markets. Question: ¿Qué es el swing trading? Answer: El swing trading es una estrategia de corto plazo en la que se compran y venden activos para aprovechar las. ¿Qué es el Swing Trading? Uno de los tipos de negociación más populares, tanto entre los traders principiantes como experimentados, es trading a medio plazo. trading, swing trading, and position trading—offers distinct que aparecen en este sitio web son marcas registradas. El logotipo de Quadcode es. Swing trading is a strategy that typically seeks to capture and capitalize on short to medium-term price movements within a broader trend. Unlike a day investor.

Qué es. K. ¿Qué es el SWING TRADING? #crypto #fyp #parati #cryptocurrency #bitcoin #trading · joveninversor TikTok video from pauljohnsonwtaw Swing trading is a type of trading in which you hold positions in stocks or other investments over a period of time that can range from one day to a few. trading automático, o sí, como quieras. Pero, solo con crear las alertas que te avisen al móvil, tú mismo podrás poner la orden. Quizá es 5. Show more. The main objective of a swing trader is to profit from swings in price movement over the course of several days. While we might trade every day, we are not day. Swing trading is a type of trading in which you hold positions in stocks or other investments over a period of time that can range from one day to a few. Sabes cu?l es la principal raz?n por la que la mayor?a de los traders novatos Read Full Overview. Edition Details Professional. ¿Quieres entender la tendencia que se sigue en el mercado de valores? Este libro es tu respuesta. El mercado financiero es uno de los mejores mercados para. Swing traders look for trades that could have a big move, either up or down. They then hold the trade until the price has gone in the direction they predicted. Establecer el stop-loss y tomar puntos de ganancia - es el precio al que un trader va a vender una acción y tomar una pérdida en el comercio (esto sucede cuando. Uno de los tipos de negociación más populares, tanto entre los traders principiantes como experimentados, es trading a medio plazo, que también se conoce como. What is Swing Trading? This style consists of the analysis charts to understand the price movements in the financial markets, thus finding uptrends and. ¿Quieres entender la tendencia que se sigue en el mercado de valores? Este libro es tu respuesta. El mercado financiero es uno de los mejores mercados para. Aprenda qué es el swing trading y en qué se diferencia del comercio de jornada. Conozca cómo usar métodos secretos para determinar el momento adecuado para. El swing trading es demasiado rápido para los inversores y demasiado lento para los day traders. Esta modalidad negociación se lleva a cabo en intervalos de. No te vas a arrepentir de leerlo y de aplicar las técnicas aprendidas, que es el objetivo real de porque la mayoría consideramos leerlo. Si estas iniciando. El swing trading es demasiado rápido para los inversores y demasiado lento para los day traders. Esta modalidad negociación se lleva a cabo en intervalos de. Cómo decidir cuál es tu estilo de trading Muchos consideran el trading como una fuente atractiva para generar ingresos, con lo que cada vez más personas se. FOREX+SWING+TRADING+MANUAL(1) - Free download as PDF File 25%A un 25% le pareció que este documento no es útil, Marcar este documento como no útil. Swing Trading #?De Principiante A Avanzado En Semanas! Las Mejores Es. Our Swing Trading Model leverages implied volatility to forecast the future price movements of an asset. Designed for short-term trading, this model provides.

What Is A Javascript Framework

This is a comparison of web frameworks for front-end web development that are heavily reliant on JavaScript code for their behavior. React. By far the most popular JavaScript framework, React calls itself “a JavaScript library for building user interfaces.” Originally released as an open-. JS Frameworks provide pre-built components and tools that accelerate development, allowing you to focus on building unique features rather than. A JavaScript framework is a pre-written collection of code that simplifies common tasks in web development. It provides a structured way to. Get started quickly with the clsteel.site JavaScript framework. You'll learn how to build reusable components and make them flexible with props, lifecycles, and slots. Best JavaScript Frameworks include: React, React Native, AngularJS, clsteel.site, clsteel.site, JQuery, Meteor, Svelte, Gatsby and clsteel.site Study the features of popular JavaScript frameworks, and use them to implement common use cases. The Progressive JavaScript Framework · Approachable. Builds on top of standard HTML, CSS and JavaScript with intuitive API and world-class documentation. JavaScript Frameworks. JavaScript frameworks are sets of JavaScript code libraries and templates to build features of an application and provide a web developer. This is a comparison of web frameworks for front-end web development that are heavily reliant on JavaScript code for their behavior. React. By far the most popular JavaScript framework, React calls itself “a JavaScript library for building user interfaces.” Originally released as an open-. JS Frameworks provide pre-built components and tools that accelerate development, allowing you to focus on building unique features rather than. A JavaScript framework is a pre-written collection of code that simplifies common tasks in web development. It provides a structured way to. Get started quickly with the clsteel.site JavaScript framework. You'll learn how to build reusable components and make them flexible with props, lifecycles, and slots. Best JavaScript Frameworks include: React, React Native, AngularJS, clsteel.site, clsteel.site, JQuery, Meteor, Svelte, Gatsby and clsteel.site Study the features of popular JavaScript frameworks, and use them to implement common use cases. The Progressive JavaScript Framework · Approachable. Builds on top of standard HTML, CSS and JavaScript with intuitive API and world-class documentation. JavaScript Frameworks. JavaScript frameworks are sets of JavaScript code libraries and templates to build features of an application and provide a web developer.

Why use Framework in JavaScript? · JavaScript Frameworks Are Tools that Get Things Done · Framework Lets You Write Fewer Lines · Faster Website Performance. A JavaScript framework is a collection of tools that help programmers to build interactive web pages. They are used for making websites and web. The Progressive JavaScript Framework · Approachable. Builds on top of standard HTML, CSS and JavaScript with intuitive API and world-class documentation. Top 6 JavaScript Frameworks for Mobile App Development · React Native · Sencha Ext JS · Vue JS · Ember JS · Node JS · Meteor JS. Meteor JS is the following. At their most basic, JS frameworks are collections of JavaScript code libraries (see below) that provide developers with pre-written JS code to use for routine. Top Front-end JavaScript Frameworks for · 1. clsteel.site: the Progressive JavaScript Framework · 2. React: · 3. Angular: Typescript-based JS Framework · 4. JavaScript often abbreviated as JS, is a programming language and core technology of the Web, alongside HTML and CSS. 99% of websites use JavaScript on the. We have listed the most popular frameworks you can use for your future projects below, along with their pros and cons for better understanding. A JavaScript framework delivers a structured and organized approach to website development. It enables programmers to easily build complex web applications with. A JavaScript framework is a pre-written collection of code that simplifies common tasks in web development. It provides a structured way to. When you're trying to define frameworks in the context of JavaScript framework vs library, think of it this way: JavaScript libraries are like pieces of. React remains the most significant framework in the web development realm. Angular (second place among frameworks) and Vue are also well-known for most front-. They're typically defined as collections of JavaScript code libraries that give developers pre-written code they can use to save time on programming routine. What Does a JavaScript Framework Do? · clsteel.site · 9. clsteel.site · 8. clsteel.site · 7. clsteel.site · 6. clsteel.site · 5. clsteel.site · 4. clsteel.site · 3. clsteel.site is a progressive JavaScript framework for building user interfaces. It was developed by Evan You and is used by companies such as Alibaba. What Is a JavaScript Framework? The collection of pre-written JS codes will help you perform common tasks faster, making JavaScript coding easier, especially. JavaScript framework is an application framework written in JavaScript where the programmers can manipulate the functions and use them for their convenience. Top 10 JS Frameworks to Watch Out in · 1. Angular · 2. React · 3. Vue · 4. clsteel.site · 5. clsteel.site · 6. Mithril · 7. Svelte · 8. Aurelia. Prototype JavaScript Framework For other uses, see Prototype-based programming. The Prototype JavaScript Framework is a JavaScript framework created by Sam. Top JavaScript Frameworks For Your Business in · 1. clsteel.site · 2. TezJS · 3. clsteel.site · 4. clsteel.site · 5. clsteel.site · 6. clsteel.site · 7. clsteel.site · 8.